Article by Martin Oelbermann

After expanding in continental and southern Europe, the global gambling industry is now going east and focusing on the Balkan states and Eastern Europe for its further expansion. Especially the Balkan states are increasingly drawing a lot of interest, despite – or perhaps because – of the current global economic crisis. And the key figures of the Balkan gambling market account for this interest: A market size of Euro 4.5 billion (gross revenue), above-average popularity of gambling, particularly of sports betting, 130 million people, and the impending EU-membership of many states, just to mention a few.

Total gambling market of Euro 4.5 billion and more to come

The Balkan gambling markets (Greece, Turkey, Croatia, Slovenia, Serbia, Montenegro, Romania, and Bulgaria) already have a remarkable market size, and most experts confirm that the Balkan markets have a great growth potential in the coming years:

- Total gambling market of Euro 4.5 billion – In 2007 the total gross revenue (after payout of prizes) of the Balkan gambling market was ca. Euro 4.5 billion according to MECN’s latest study about the region; the figure for turnover/wagers came to ca. Euro 25 billion. These figures include only gambling operations with local licenses. If the business of foreign online gambling operators were included, the overall market size would exceed Euro 5 billion.

- Great growth potential – More than 60% of the experts surveyed by MECN believe that the growth potential of the Balkan gambling market is great or even very great. Hardly any market insiders (only 3% all surveyed experts) believe the market has only a small growth potential.

- Increasing liberalisation – On the whole, the experts believe that the Balkan nations will liberalise their gambling markets.

Total Balkan online gambling market worth ca. Euro 520 million

The Balkan markets enjoy a growing Internet and broadband penetration. In total, there are about 43 million Internet users (average penetration rate of ca. 36%) and about 7 million broadband connections. Nevertheless, these figures are below the European average and still leave room for significant growth.

According to MECN’s estimates, the Balkan states as a whole have an online gambling market worth about Euro 520 million (gross revenue), and most of the revenue is made by foreign operators without local licenses. But the market size differs significantly from country to country, and Turkey and Greece have the largest markets.

The key factor influencing the size of the online gambling market is the market structure (foremost of the betting sector): Whereas in competitive markets, such as Croatia, Serbia, and Romania, the foreign online gambling operators can capture only about 1%-3% of the total market, the situation is very different in monopolistic markets such as those in Greece and Turkey. In such markets some foreign online operators alone can realise Euro 20-30 million in gross revenues annually.

Online gambling and betting sectors drive the Balkan gambling market

The market worldwide is driven to a large extent by betting and interactive gambling. The market insiders surveyed by MECN see these two sectors as having the biggest growth potential for the Balkan market as well. Traditional games, such as lotteries and casino, are expected to have a rather limited growth potential.

Exhibit: Industry sectors with the biggest growth potential in the Balkan gambling market – Results of MECN survey

Some forerunners among the gambling operators are paving the way

Some forerunners among the global key players in the retail and online gambling market are already getting established in the Balkan states. Regarding online gambling, Sportingbet is currently realising about 5% of its business in Bulgaria alone whereas Bwin and Bet-at-home have just recently increased their focus and investments in the Balkan region.

Leading Internet operators offer localised offerings in nearly all Balkan states

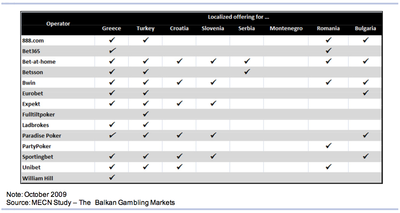

More and more Internet operators are adding Balkan languages and currencies to their localised offerings. As the exhibit below shows, nearly all of the operators analysed offer localised versions in Turkey and Greece whereas Serbia and Montenegro still seem to be uncharted territory in this respect.

Exhibit: Overview ogambling operators

Future investment strategy of gambling operators – it’s time to think

According to the MECN report, about 20%-30% of the operators surveyed are currently planning to increase their investment in the Balkans – primarily in Croatia, Romania, and Greece. The majority of the operators surveyed are currently in the process of developing their Balkan market strategy and evaluating whether/how to increase their investment and focus in the near future. A worthwhile exercise, we think.

The MECN study can be obtained at: http://www.balkan-gambling.mecn.net

MECN is a network of experts and consultants advising, among others, clients in the gambling industry. For more information, please visit us at http://www.mecn.net