How insic is redefining the use of Artificial Intelligence for player protection and anti-money laundering

Artificial Intelligence is no longer a topic of the future. It is operational reality. The latest generation of so-called Large Language Models (LLM) now enables what was unthinkable only a few years ago: precise, transparent, and client-specific risk assessments based on proprietary training data.

The decisive lever here is the prompt – a targeted instruction to the language model designed to extract clear, action-oriented results from complex datasets. Unlike traditional prompt engineering, the insic system generates these prompts autonomously, dynamically, context-sensitively, and based on continuously evaluated monitoring data.

A prompt is more than just a line of text input. It is a structured instruction that precisely defines the objective, context, audience, output format, and professional parameters. In the field of player protection or anti-money laundering, this means the AI is assigned a clearly defined role – for example, that of a compliance or AML officer – and evaluates suspicious transactions from that perspective.

What makes the insic solution unique

The monitoring system itself provides the training data by continuously analysing transactions that are manually or automatically flagged as critical. This results in an ongoing learning process that requires no separate training runs. Within just a few hours, the system detects client-specific patterns and automatically adapts the prompt structure to local requirements.

The weighting of transaction types, from intentionally lower-rated standard cases to high-priority risk indicators, can be controlled in detail. A “one-fits-all” approach is neither professionally viable nor technically effective.

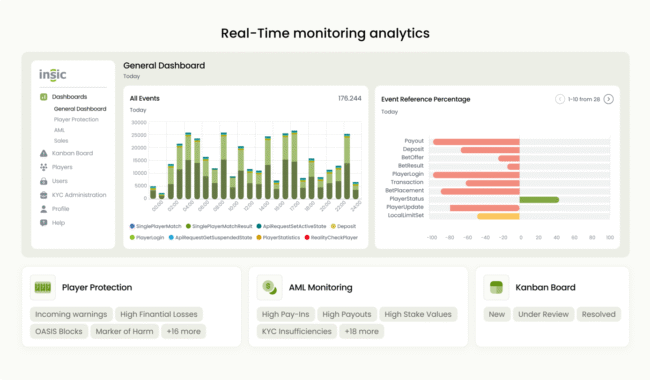

Since 2024, insic has been the first provider on the market to analyse data transmitted in real time via SAFE to the authorities, to visualise it in modern dashboards for player protection and AML, to link it to its own online risk management system for franchise organisations, and to interpret the results in line with the latest AI standards.

Data protection is not an afterthought but a core principle. All system components run within the client’s own infrastructure. There is no transfer to external data centres and no sharing with global data corporations.

The result

You process your data on your own systems, train your own AI model, and maintain full sovereignty over your sensitive information at all times.

insic – Cutting-edge technology, uncompromising data protection, maximum professional relevance.

Learn more. Contact us today or meet us in person at the IDX Summit in Hamburg.

Quelle: insic GmbH