Sports betting has been part of our culture since ancient times. However, a lot has changed from the days when gamblers bet on gladiatorial fights to when gamblers nowadays are betting online from the comfort of their couches.

According to a study, the global online gambling and betting market was valued at $ 50 billion in 2019 and is projected to reach $ 100 billion by 2026. The global online gambling and betting market is expected to grow at an average annual growth rate of 10% from 2019 to 2026.

The growth of the global gambling market is currently being driven primarily by North America and Europe, encouraged by factors such as the increase in per capita income, the high level of acceptance and the growing interest of the younger population as well as the increasing legalization of gambling.

Due to the further development of sports betting, different habits and trends have emerged in the various markets. Depending on the cultural and political circumstances, there are strong differences in the modalities and possibilities of sports betting from country to country. International betting providers in particular are faced with the challenge of adapting their products, their offerings and their marketing to the requirements of the respective markets.

In this article, the special characteristics and habits of the various markets are to be examined in more detail and discussed with regard to current trends. In part one we are going to address the markets of Europe, the Middle East and Africa.

Europe

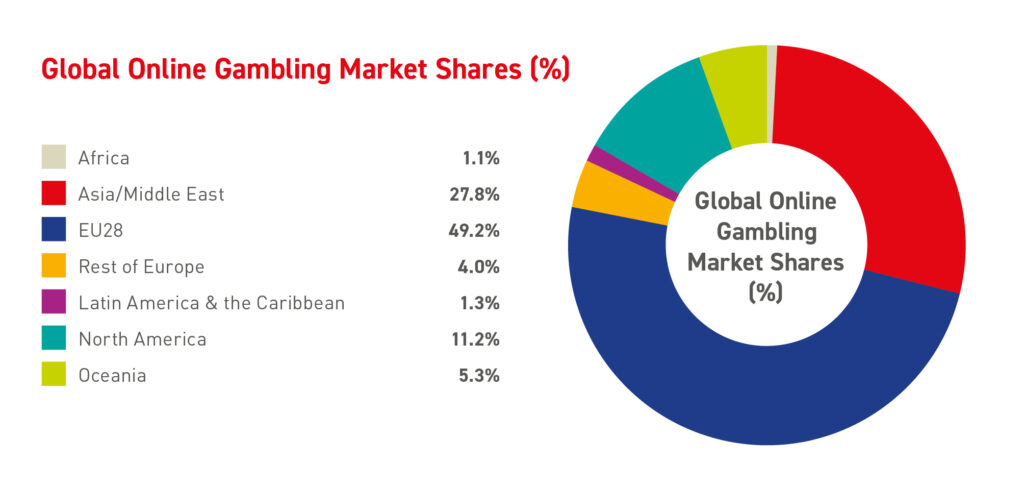

The EU market is the largest and most competitive for online gambling. In 2018, the EU accounted for 49.2% of the global online gambling market and this is expected to remain relatively stable until at least 2020. With sports betting legalized in some US states, European companies are now beginning to gain a foothold in the US market, increasing their influence and bringing their expertise to new markets.

There is no sector-specific EU legislation in the area of gambling. The EU countries are autonomous in the way they organize their gambling services, although in most EU countries at least some games of chance can be offered on the internet.

The market generates much of its revenue (as measured by gross gaming revenue / GGR) in the UK, Italy, France, Spain and Germany as most companies use expansion into regulated markets as a strategy to generate sustainable revenue. The most popular sports in Europe are football and tennis.

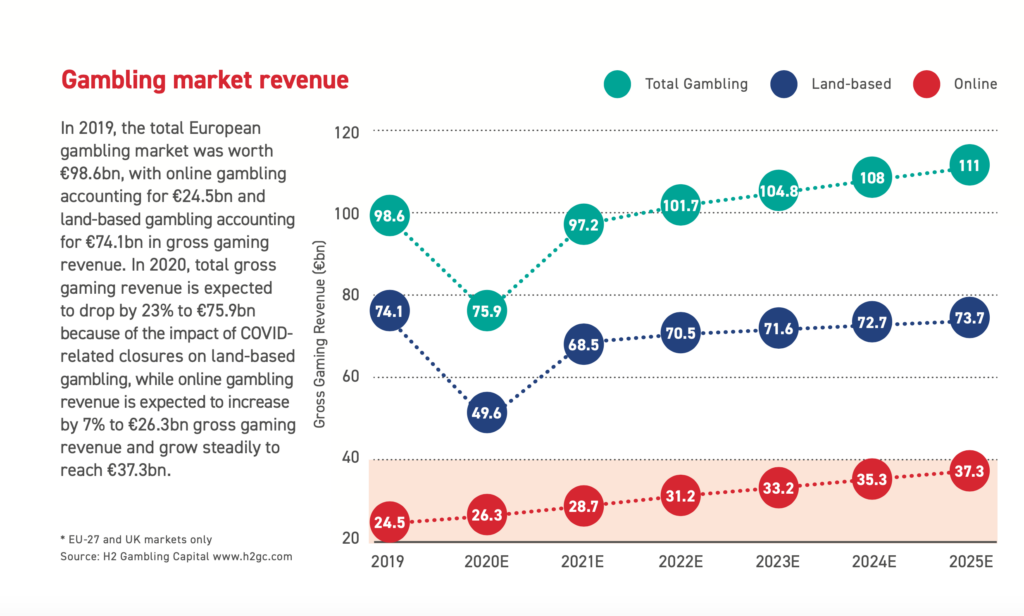

Above all, the growth of the European online gambling market was motivated by the exponential popularity and the increasing number of live casinos and sports betting, the burgeoning hardware and software innovations as well as the improved usability and accessibility of the Internet. With the rise of technology and the increase in online users, the European iGaming market is growing steadily and is expected to show an annual growth rate of almost 10% until 2025 – the online sector is thus growing significantly faster than retail casinos or betting shops. The economic size (or gross gaming revenue) of the EU online sector is projected to increase from € 22.2 billion in 2018 to € 29.3 billion in 2022. Strong growth in the online sector in countries such as Spain, but also Italy, France and Germany could be due, among other things, to the fact that online penetration of the entire gaming market in these markets is still relatively low compared to other European countries.

In addition, the regulated sports betting market in Europe is growing steadily. In 2019, Europe had a channeling rate for the online gambling market of 73.5%, which means that almost three quarters of online gambling activity was in the regulated market, while 26.5% of the activity was in gray and black markets. The share of online gaming in the regulated market is expected to increase to 80.1% by 2022 and then decrease slightly to 79.6% by 2025 (source: EGBA).

Information on the effects of COVID19 on the European gaming industry, as well as forecasts for the next few years, can be found in the following article: Sports betting in the Corona crisis: A future outlook

Middle East & Northern Africa

Most of the time, casinos, sports betting, and online gambling are illegal throughout the Middle East. Despite the applicable laws prohibiting Muslims from gambling, Middle Eastern gamblers account for a significant proportion of global gambling industry revenues.

Interestingly, there is also a long history of gambling in Islamic culture, as ancient civilizations such as the Assyrians had built a spectacular gambling industry in their golden age. Bookmakers and auctioneers organized large shows and gambling events that attracted large crowds. The modern bookkeeping and bookmaking industries of the region began and developed during this time. The ancient civilization of Egypt already had a lively gambling culture.

Nowadays, many Muslim majority countries have chosen to only offer casino games to foreigners or non-Muslim visitors – players must present their passports at the door to gain entry. In the Middle East, however, many people have dual citizenship and still gain access to casinos. In addition, high tax rates and impractical regulatory barriers often hamper the performance of these casinos. In Egypt, for example, the roughly 14 casinos of Kairo generate gross gaming revenues (GGR) of over US $ 200 million annually – of which the casinos, however, have to pay a gaming tax of 50% (GGR), which must be paid on a daily basis.

Although the expansion of the casino industry is subject to strict Islamic laws, most regions in the Middle East allow visiting foreign websites. Because as long as foreign online casino operators are used, less strict laws apply. For this reason, software developers in the Middle East are increasingly licensing their games to overseas casinos with a strong online presence that accept online players from the region. Especially the citizens of Lebanon, Israel and Egypt as well as the United Arab Emirates are now offered online casinos that explicitly target their country.

Sports betting are enjoying great popularity in the Arab world only recently. Soccer, camel races, formula and horse races are some of the most popular sporting events, with soccer being the most popular – among other things, because some of the best national soccer leagues and teams in Asia are among the Arab nations and the regions of the Middle East. The locals are enthusiastic about both local and international sporting events and use well-known international online betting platforms to bet on their favorite teams. However, these platforms only meet the wagering requirements of the Arab population to a limited extent, as translations into Arabic and regional languages are often missing.

As a betting provider, it is therefore important to research the needs of this market in detail and to adapt the betting experience specifically for the domestic market. The legal framework for the individual countries can be found here, among other things.

Africa

The gambling industry in Africa is growing steadily and, according to experts, has the potential to change the African continent’s economy in the long term. Many leading iGaming providers see Africa as a lucrative region in which to expand. Thanks to their economic dynamics and enthusiasm for online sports betting, countries such as South Africa, Nigeria and Kenya offer numerous opportunities for investors. In 2018, Nigeria, Kenya, and South Africa were estimated to hit $ 40 billion.

At the moment, sports betting in Africa mainly offers bets on soccer and horse racing. In North Africa there is great interest in horse racing, which dates back to the 15th century. Africans have reportedly been betting on soccer for more than 70 years. Most African players have user accounts on international online betting platforms such as Betway, which operate internationally.

South Africa is the continent’s largest gambling market. While the National Gambling Act of 2004, which fundamentally bans all games of chance including online casino, slot machines and card games, wagering on sports and horse racing are in physical or online venues approved by one of the nine provincial licensing authorities (PLAs) that only permitted form of gambling. According to reports from the South African government, more than half of South African adults regularly place sports bets. Some predictions suggest that gross gaming revenue will surpass the $ 2.3 billion mark by 2023.

Nigeria has by far the largest population and the largest gross domestic product in Africa and, with a share of 7% of the entire continent, is the largest gaming market (measured by the GGR) in sub-Saharan Africa. The gambling ban to which Nigeria was subjected was lifted in 2004, opening the door to investment in the sector. According to a 2014 survey, around 30% of Nigerians between the ages of 18 and 40 place sports bets on a daily basis: that’s a market of over 65 million players who spend an average of around USD 15 on sports bets a day.

The steady growth of the sports betting industry in Africa can be attributed, among other things, to the great passion for sport of the African population, with football being the most popular sport on the continent. Other sports that also receive a lot of attention from Africans are cricket, rugby, and running racing. In addition, African youth are big fans of European leagues and other FIFA events. Most players usually place their bets on the top European leagues such as EPL, La Liga, Serie A and Bundesliga, with the EPL being probably the most popular league on the continent. But other European tournaments such as the UEFA Champions League and UEFA Europa League are also very popular.

The potential of the African sports betting industry is based on its youthful population. According to statistics, over 200 million Africans are between 18 and 24 years old. This young generation has no problem with placing sports betting mobile on their smartphone. In addition, the high unemployment rates are another incentive to gamble online for a living.

An online or mobile first with an offer adapted to the preferences of the local population is therefore essential for betting providers in the African region.

Conclusion

In Europe and Africa in particular, there has been a strong trend towards online gambling and sports betting for a long time, which defines the strategy of most betting companies. The cultural and socio-economic framework conditions in each market also speak in favor of future growth in the industry. While the Middle East still poses challenges due to the legal and cultural situation as well as the language requirements, the potential of this market cannot be denied.

In part 2 of the article you will soon learn more about the markets of Asia, the USA and South America!

Do you need more information about your target market? The Arland experts will be happy to advise you individually on your project! Just write to us at [email protected]