Risk management is the backbone of every sports betting operation. It makes running a betting company a viable business model rather than literal gambling.

Trained bookmakers are able to adapt the range of leagues, events and types of betting to the target market. In addition, they have the task of managing the risk and thereby ensuring security and profit for the company. Professional risk management with modern risk management tools is therefore essential for the long-term success of a sports betting company.

The sports betting risk management approach

There are different approaches to risk management in sports betting, each with its own set of advantages and disadvantages. A common approach is working with so-called loss limits.

This means that betting odds will be blocked when a pre-defined loss limit is reached. If there are additional bets on the opposing odds to offset the potential loss on the first odds, the odds will become playable again. It allows the providers to minimize their risk and at the same time achieve high sales.

An example:

- For a soccer game between Germany and Spain, the bettors of a German betting provider place a lot of bets on the German team (odds “1” of the market “1X2”). The market is out of balance and the loss limit for odds “1” has been reached.

- The odds “1” are automatically no longer available for betting. However, bets can still be accepted for odds “X” and “2”. Bookmakers can, for example, increase the odds for the Spanish team at this point in order to “balance the book”. Or they can wait until enough bets have been placed on the market “X” / “2”.

- After several bets have been placed on the odds “X” and “2”, the market will balance out and the odds “1” can be bet on again.

The defined risk is never exceeded. At the same time, you can bet on the markets for as long as possible. The risk is minimized, the turnover maximized!

Challenges

One of the greatest challenges in the implementation of risk management strategies is the fact that they need to be individual for each company and target market (e.g. France, Germany, Brazil, Belgium, etc.).

This is because the framework conditions and requirements of different markets and player groups usually vary significantly. Especially the legal framework and compliance requirements for the risk management can differ from country to country.

Last but not least, the risk management strategy should also be in line with the corporate goals. This is necessary to ensure long-term growth and security. It therefore makes sense to take approaches that prioritize the long-term viability of the entire system. Marketing strategies can then be coordinated with the risk management team to align short-term goals with long-term strategic goals.

On the technical side the professional and safe implementation of the processes has to be guaranteed as well. Modern betting platforms are usually equipped with the appropriate systems and tools for this purpose. You will learn more about this in the next part!

Sports betting risk management with Bookmaker NEXT

When developing the sports betting software Bookmaker NEXT, ARLAND relied on more than two decades of experience in the sports betting industry. As a result, a number of comprehensive risk management tools have been developed in close cooperation with their competent team of risk management experts. Based on the loss limit approach, they cover all areas necessary for successful risk management.

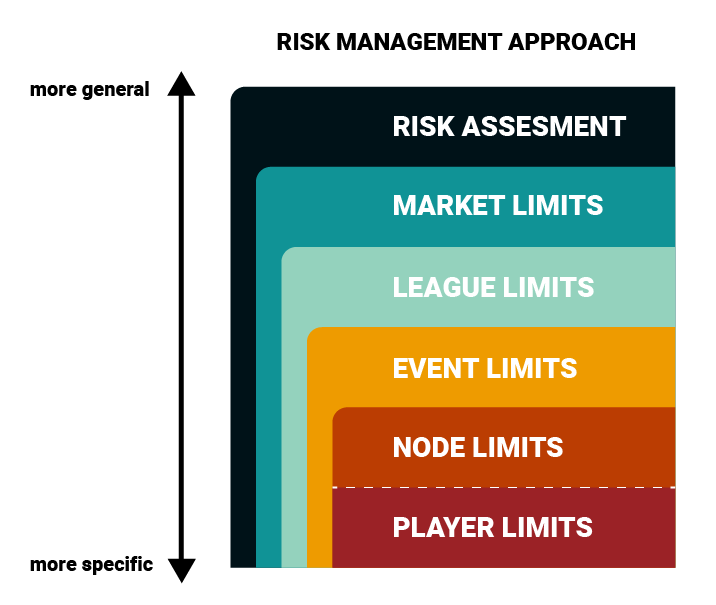

Bookmaker NEXT takes a flexible approach to enable the implementation of various risk management strategies. These strategies are determined by the sports betting provider based on its own risk assessment processes and legal framework. The defined strategies can then be implemented using a variety of risk rules and risk management tools available in the Bookmaker NEXT platform.

Automation

A large part of the risk management measures can be automated – this enables bookmakers to concentrate on creating an attractive offer.

Bookmaker NEXT allows certain customers (usually well-informed players who have an unfair advantage over the bookmaker’s position) and unwanted bets to be prevented from jeopardizing the profitability of the betting business. For this purpose, the system provides the ability to automatically detect, monitor and manage potential malicious behavior or unbalanced weather events that could pose a financial threat to operations.

Hierarchical loss limits for markets, leagues, events, nodes and players are used preventively. This approach enables risk managers to identify and anticipate threats, such as unwanted financial risks.

Since these limits are set in advance and are automatically applied, risk managers no longer have to make ongoing adjustments and can instead concentrate fully on monitoring incoming bets. An exceedence of the limits isautomatically reported using “Alerts”, which can be adapted to various risk management processes.

How can I best protect my company using risk management processes?

There are basically 2 options for risk management in a sports betting company:

1. Own risk management

In order to protect your company from fraud, errors or excessive profit distributions to betting customers, you need professional risk management and the professional implementation of KYC (“Know Your Customer”) processes. Usually this is an in-house department of the betting company. It consists of trained bookmakers and risk managers who are busy 24/7 monitoring customers, games and bets.

Read also: KYC – Challenges for sports betting providers

Running the risk management completely in-house always has the advantage that you retain maximum control over your operation. However, it is also associated with a large amount of staff. ARLAND will be happy to advise you on how to set up your risk management team. The skills of your team can be expanded through targeted trainings and workshops by ARLAND.

2. Outsourcing of the risk management

Often there is also the option of outsourcing your own risk management processes to the software provider. At Arland, we offer you the opportunity to use our bookmakers’ many years of know-how for your business and to let us take over all risk management processes. Customer identification within the framework of KYC processes can also be outsourced to specialized companies.

With the help of MTS (Managed Trading Services) from BETRADAR, a large part of the risk management can be outsourced as well, which drastically reduces the necessary size of your own team. This means that employees are only required to determine the sports betting offer for the platform, as well as to intervene in exceptional cases.

Conclusion

For the sustainable success of a betting company, efficient and professional risk management is not only useful, but essential. Since this area ensures the long-term security and profitability of the company, betting providers should invest in reliable tools and a competent risk management team!

Would you like to find out how you can optimize the risk management of your sports betting company? Send us a mail to [email protected]!