Malta / Ahrensburg. The EU legislation on AML has introduced a number of challenges to the iGaming sector. Whilst significant emphasis has been placed on the onboarding process, the legislation also focusses greatly on the ongoing monitoring of your customers – i.e. the way that your customers transact with you over time.

Malta / Ahrensburg. The EU legislation on AML has introduced a number of challenges to the iGaming sector. Whilst significant emphasis has been placed on the onboarding process, the legislation also focusses greatly on the ongoing monitoring of your customers – i.e. the way that your customers transact with you over time.

Many organisations have invested in sophisticated systems and controls with the aim of meeting compliance regulations. Two major challenges that the iGaming, banking, and financial institutions have faced are:

- Changes in regulatory requirements over time

- Controls / processes that are subject to human error

The AXON Transaction Monitoring solution from Computime addresses these key areas.

What makes AXON different is that it is much more than a rules engine. The key factors that make AXON so powerful are:

- Real-time alerts

- Considers the KYC information collected as one of the data sources

- Flexible rule definition methodology

AXON constantly checks players in real-time to meet the AML requirement on threshold of deposits or withdrawals. The payment method being used, along with deposit or withdrawal values, will be utilised to drive logical checks and related triggers to the KYC platform.

SAFE server technology and AML reporting with AXON

Across Europe, authorities have defined the SAFE server technology with its user based financial bookings and gaming transactions including winnings, losses, and cancellations as their primary source for external compliance monitoring. In cooperation with the insic SAFE server technology, AXON has aligned its standardised compliance reporting with an open AML ruleset in order to comply with real-time monitoring needs. As European operators already utilise SAFE server interfaces, it now becomes possible to quickly setup a real-time alert system without launching a large-scale IT project.

Having understood the marketing requirements and added campaign information to the given data entities, it is now possible to allow marketing reporting and compliance monitoring via the same big data engine.

Why KYC information is a critical source of data

With many transaction monitoring systems, the number of notifications generated can mean that the compliance team is alerted very often. With a large percentage of these alerts, no action is required from the compliance team since the relevant KYC documentation has already been collected via insic KYC services. AXON Transaction Monitoring provides flexibility in filtering by taking into consideration the current information available against the customer. In this way AXON goes beyond the traditional rule-based methodology.

- The level of information / documentation collected for a subject person is part of the rule filter, ensuring that the compliance team are only provided with alerts and notifications which add value to the compliance operation.

- Past notifications and compliance team actions are also considered as part of the rule engine computation.

- Different rules can be applied to different customers based on the documentation attained, the type of customer, and other key data such as country or preferred payment methods.

The analysis on transaction level, together with historical information collected on the customer, builds a complete profile of the customer and their ongoing activities post onboarding.

How do we understand behaviour from transactions?

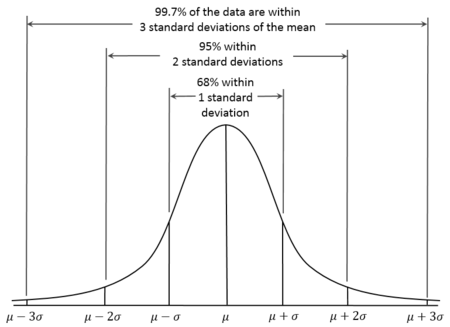

The definition of what is considered ‘normal’ behaviour is an extension of the organisations risk appetite. There are three main account level identifiers to anomalous behaviour patterns.

- Transactions beyond typical thresholds – i.e. the value of the transactions.

- The frequency of payments / withdrawals over time – i.e. the volume of the transactions.

- The speed at which deposits and withdrawals are made across accounts – velocity.

The transactional activity allows a profile to be defined of what is ‘normal’ behaviour for that customer.

How does AXON do it?

Customer profiling is used to understand what is considered ‘normal’ behaviour at account level. Using checks on each transaction against the individual’s profile will allow identification of the ‘occasional’ transaction that does not meet the data subjects past history. These metrics are maintained in real-time for each data subject allowing alerts to be generated immediately when out of profile activity occurs.

The functionality within AXON caters for a fully customised approach with the ability to easily create additional scenarios as iGaming legislation evolves.

AXON offers you a complete ongoing monitoring package through the profiling and analysis of player behaviour from a transactional perspective. With insic this can be deployed quickly giving you the peace of mind that no transactions are overlooked and thereby empowering your compliance team with the right information at the right time.

Quelle: insic GmbH